Numerical Portfolio Ingestion Brief for 635250222, 8008507655, 120093074, 6936920163, 21541897, 3301359954Numerical Portfolio Ingestion Brief for

The Numerical Portfolio Ingestion Brief outlines the systematic processes for integrating financial data linked to specific asset identifiers such as 635250222 and 8008507655. Attention to detail in data collection is crucial, as it directly impacts asset classification and performance tracking. By employing advanced methodologies, investors can enhance their decision-making capabilities. However, the implications of these processes extend beyond mere data accuracy, raising questions about their long-term effects on investment strategies.

Understanding Numerical Portfolio Ingestion

Numerical portfolio ingestion is a critical process in financial management that involves the systematic collection and integration of quantitative data related to investment assets.

Effective ingestion processes require rigorous data validation to ensure accuracy and reliability. This foundational step enhances decision-making capabilities, allowing investors to maintain control and freedom in their financial strategies while optimizing asset performance through precise data insights.

Key Identifiers and Their Significance

Key identifiers play a pivotal role in the numerical portfolio ingestion process, serving as critical markers for asset classification, performance tracking, and risk assessment.

Their identifier importance lies in facilitating accurate data classification, which enhances decision-making capabilities.

Methodologies for Effective Data Handling

Effective data handling methodologies are essential for optimizing the numerical portfolio ingestion process, as they ensure the integrity and usability of financial data throughout its lifecycle.

Prioritizing data quality fosters accurate insights, while implementing streamlined workflows enhances processing efficiency.

Enhancing Decision-Making Through Technology

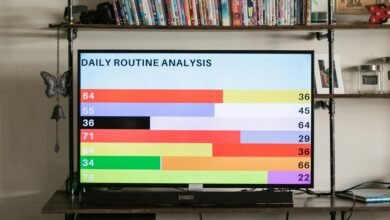

While the integration of advanced technologies into financial processes may seem daunting, it presents a unique opportunity to enhance decision-making capabilities within organizations.

Leveraging data visualization allows stakeholders to interpret complex datasets intuitively, while predictive analytics enables informed forecasting.

Conclusion

In conclusion, the numerical portfolio ingestion framework serves as the backbone of effective financial data management, akin to a well-tuned engine driving investment strategies. By emphasizing the importance of key identifiers and leveraging advanced methodologies, investors can enhance their decision-making processes significantly. The integration of technology not only ensures data accuracy but also streamlines asset performance tracking, ultimately fostering a more informed and strategic approach to financial investments.